Aging Populations and Great Power Politics: The Problem Is for the Elites, Not the Masses

Written by Dean Baker, Senior Economist, Center for Economic and Policy Research (CEPR) | Published: September 11, 2023

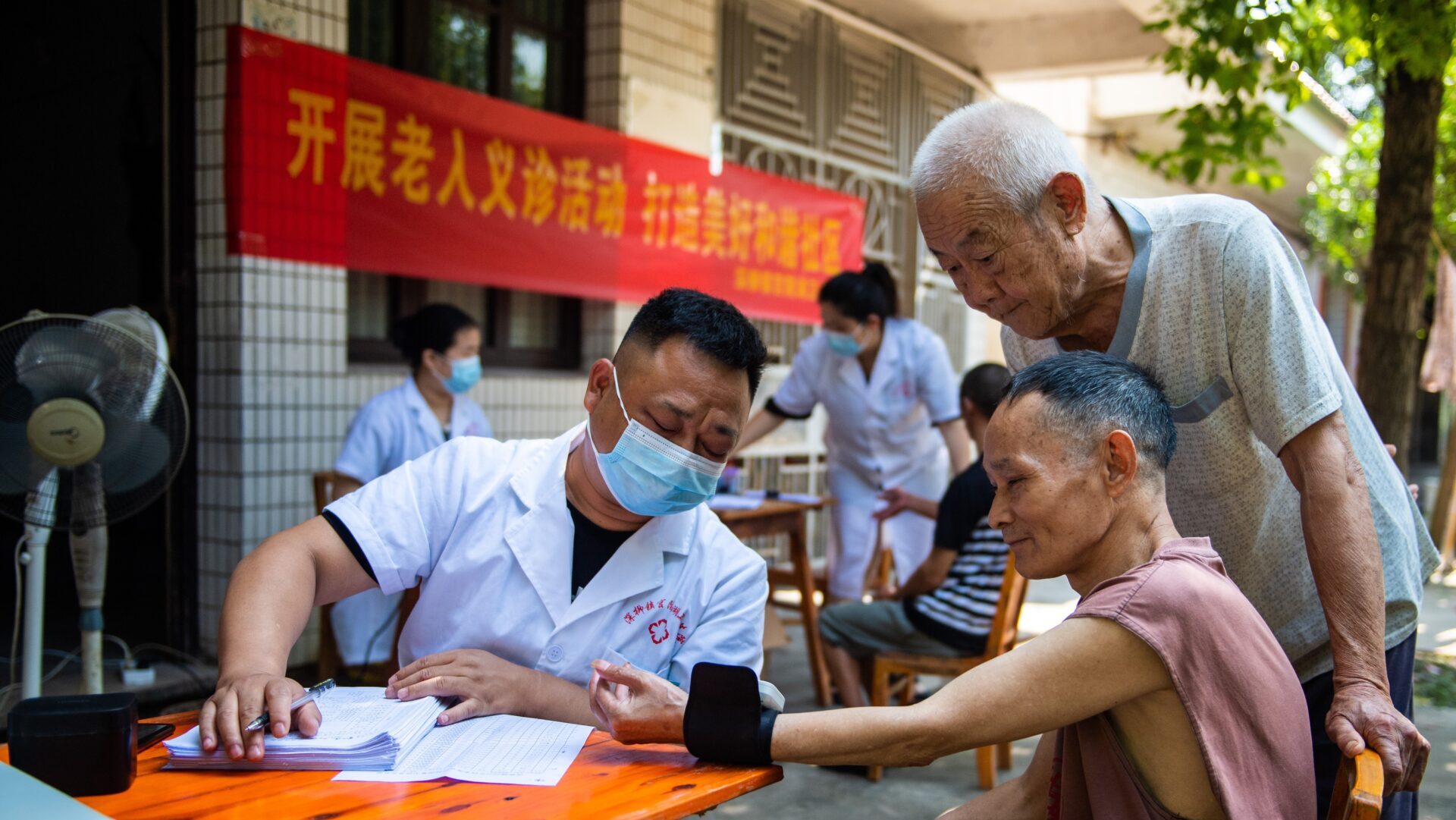

We recently got new data showing that China’s population shrunk last year. It is now projected to see its population continue to decline through the rest of this century.

This is being portrayed as a disaster for China. A similar “disaster” has already hit Japan, South Korea, Italy, and many other wealthy countries. People in these countries are having fewer kids than they did in prior decades. Unless they make up for their low birth rates with high rates of immigration, they will see declining populations, which we are supposed to believe is a terrible disaster. In fact, although declining populations may be a problem for political leaders who want to be more important in international politics, they are not bad news for the people of a country.

Before directly addressing the looming disaster story, let me just say that many of the policies that countries have adopted to promote population growth are good in their own right, whether or not they lead to those countries’ objective of more rapid population growth. Parents of young children should be able to get time off from work to be with their kids. They should also have access to affordable child care. And we should have something equivalent to the expanded child tax credit to ensure that even low-income families can provide basic necessities for their kids.

These policies are important because having kids should be a manageable task for parents rather than an impossible burden. If people choose to have kids, they should be able to do so without it wrecking their lives.

We should also want every kid to have a decent chance in life. This means, at the minimum, ensuring that they have decent nutrition and housing and access to medical care. This can be done at a relatively low cost to society and should not really be an arguable point.

But getting beyond these issues, the question is whether societies will really suffer if they see a secular decline in population over many decades. While it is fashionable among intellectual types to assert that falling populations are a disaster, the logic for this argument is lacking.

The essence of the disaster story is that we will have fewer workers to support a growing population of retirees. The implication is that either retirees will have to get by with less money or workers will face an impossible tax burden.

There are two basic flaws in this argument:

- The impact of normal productivity growth swamps the impact of demographic changes, and

- It’s not clear that supply constraints (i.e., too few workers, too many retirees) are even the main problem facing aging societies. The widely accepted story of “secular stagnation” is that aging societies suffer from too little demand, the complete opposite problem of too few workers.

Taking these in turn, it should be clear to anyone familiar with economic data that even modest rates of productivity growth have far more impact on living standards than changing demographics. The years 2010 to 2025 are the peak years of the retirement of the baby boom cohort in the United States. The Social Security Trustees project that the aged dependency ratio (the number of people over age 65 divided by the number of people between the ages of 20 and 64) will increase from 0.218 in 2010 to 0.325 in 2025.

This is a story of a rapidly aging society since we had a long period of very high birth rates following the end of World War II, followed by decades of much lower birth rates. As a result, the United States is seeing a more rapid aging of its population than most countries with declining birth rates are likely to experience. Yet, this still should be a relatively manageable problem.

Suppose that productivity growth averages 1.0 percent annually over this 15-year period, which is a slower pace than we have ever seen over any 15-year period in the United States. If wage growth moves in step with productivity (that’s a big if, but has nothing directly to do with demographics), before-tax real wages would be 16 percent higher at the end of this period.

Suppose that people over age 65 consume 70 percent as much per person as the working-age population, and that we tax workers to ensure the older population gets their 70 percent. In this case, both workers and retirees can see an 8.9 percent increase in income over this 15-year period. And this doesn’t even account for the fact that we are seeing a decline in the youth dependency ratio and also that an increasing share of the over-65 population is likely to be working as older people have better health and a larger share of jobs are not physically demanding. It’s hard to see a crisis here.

And this is the story for the period of the peak rate of retirement of the baby boom cohort. In a story where we continue to see low birth rates and a declining population, the ratio of retirees to workers will continue to grow, but not as rapidly as in the peak years of the baby boomers’ retirement.

Furthermore, we can plausibly see more rapid rates of productivity growth. If productivity growth were to average 2.0 percent over a 15-year period, roughly the post-World War II average, the before-tax real wage would rise by almost 35 percent. This would allow for a gain in after-tax income for both workers and retirees of more than 20 percent, even with the rapid increase in the ratio of retirees to workers associated with the retirement of the baby boomers.

And many countries, notably China, have seen far more rapid increases in productivity. China has been averaging productivity growth of more than 4.0 percent annually in recent decades as people have moved from very low-productivity work in agriculture to much higher-productivity jobs in manufacturing. It is approaching the end of this shift, as more than 62 percent of the population is now urban, but it still may see productivity growth that far exceeds the 2.0 percent that the U.S. has averaged over the last 75 years.

Also, there are benefits from a smaller population that GDP does not pick up. Parks, beaches, museums, and other recreational areas will be less crowded. There will be less congestion and pollution. There will also be less strain on infrastructure. None of these factors are picked up in the GDP accounts or measures of productivity.

In short, there is no reason to believe that a country will see stagnant or declining living standards simply because it has a rising ratio of retirees to workers. If, for some reason, it stops seeing gains in productivity, then living standards could stagnate or decline, but the issue here is the weak productivity growth, not the aging of the population.

It would be very dishonest to imply that a country in such circumstances is suffering due to the aging of the population, a problem that cannot be easily remedied. By contrast, factors that impede productivity growth may be difficult to address politically but are likely much more easily solved than finding a way to substantially increase birth rates. (Increasing immigration is easier.)

It is also important to recognize that increasing birth rates actually makes the situation worse in the near term, as it increases the number of children that each worker must support. In the United States, the combined young and old dependency ratio hit a peak, due to the baby boom, in the early 1960s that is likely to never be surpassed. It will take more than 25 years before an increase in the birth rate can begin to lower the overall dependency ratio.

Is too few workers even a problem?

While increases in productivity should ensure that a rise in the ratio of retirees to workers doesn’t lead to a drop in living standards, there is an even more basic question about the impact of an aging population. After decades in which policy debates focused on being able to meet the demand created by a growing cohort of retirees, it turns out that the major economic problem in this context may be too little demand, or secular stagnation.

What we have seen first and foremost in Japan, but also in other wealthy countries with a growing share of retirees in their populations, is that insufficient demand is a major problem. This is the direct opposite of the story where the economy is unable to meet the demand created by retirees, resulting in high interest rates and high inflation.

In fact, prior to the pandemic, most wealthy countries had near-zero interest rates in their overnight money markets, and even longer-term government bonds carried unusually low interest rates. The interest rate on Japan’s 10-year Treasury bonds was generally negative in the years since the Great Recession.

Rather than being troubled by inflation rates that were too high, central banks were actually struggling to raise inflation rates to their targets. And, even as many governments ran large deficits to help support their economy, the debt service was not imposing a major burden.

Japan again is the poster child. In spite of having a debt of 260 percent of its GDP, until recently, investors were paying the government to hold its debt, as its bonds carried a negative nominal interest rate. The country’s current interest burden is roughly 0.3 percent of GDP. That compares to 1.7 percent in the United States at present and more than 3.0 percent in the 1990s.

In short, the evidence from the decade prior to the pandemic is that the concern that a rising ratio of retirees to workers would place an impossible burden on the economy was entirely misplaced. The biggest problem posed by an aging population is that investment falls, as businesses no longer need to expand their capital stock to accommodate a growing workforce.

The quickest way to offset weak demand is to have the government spend more money. Ideally, this spending should be in areas that provide both current and lasting benefits, like child care and education, but any spending can generate demand in the economy. But in any case, lack of demand appears to be the major problem associated with an aging society and falling population. This does not look like a major crisis.

Declining populations as a problem for politicians, policy types, and pundits

If the prospect of an aging society and declining population does not pose a major problem for most of the people living in a country, the story is different for politicians looking for power. The typical person in Denmark or the Netherlands does not have a worse standard of living than the typical person in the United States, and by many measures, they are doing better.

However, there is a reason that most people in the world know about President Biden, whereas few people outside of Denmark or the Netherlands would know the names of their prime ministers. The difference is that the United States has 330 million people, compared to 6 million in Denmark and 18 million in the Netherlands. The policies pursued by a rich country with 330 million people make a big difference in the world. The policies pursued by rich countries with 6 million or 18 million matter far less.

If politicians are seeking power, it is much better to be running a big country than a small one. For this reason, the prospect of a shrinking population looks like bad news to many of them. And this sort of concern goes far beyond just the small number of people who might actually be running a country or a top policy adviser.

There is a much larger group of academics, commentators, or generic pundits whose views matter much less when they are directed to the government of Denmark or the Netherlands than when they are presenting their wisdom to guide the policies of the United States. If that seems hard to fathom, imagine Thomas Friedman directing his bold pronouncements to the Prime Minister of Denmark rather than the President of the United States. It just wouldn’t pack the same punch.

While these commentators may be a tiny share of the population, they are a very large share of the people whose views about things like a shrinking population get attention in major media outlets. In short, the people whose status depends on addressing their remarks to a major power are the ones telling us that we should be very worried about our country becoming a lesser power, no surprises here.

There is one last point to be made about how the quest for great power status may diverge from the interests of most of the population. The traditional way to secure great power status is through military power.

This can be expensive. At the peak of the Reagan era military buildup, we were spending 6.0 percent of GDP on the military. We are currently spending a bit more than 3.0 percent. The difference of 3.0 percentage points of GDP is more than twice the projected increase in spending on Social Security as a share of GDP between 2000 and 2030, the years of the retirement of the baby boom generation.

There is a further issue that the Soviet Union’s economy, at its peak, was around 60 percent of the size of the U.S. economy. By contrast, China’s economy is already about 20 percent larger than the U.S. economy and is projected to continue to grow more rapidly for the foreseeable future. This means that a full-fledged arms race with China is likely to be far more expensive than the Cold War with the Soviet Union. That would likely impose a serious burden on the U.S. economy.

Conclusion: Shrinking populations are not a problem

As a practical matter, there is little reason for the overwhelming majority of the country to be concerned about a declining population. The impact of aging on living standards is limited and much smaller than other burdens the country has borne in the past, such as paying for the care and education of the baby boom generation when they were children. Furthermore, the gains from higher productivity should swamp the impact of a rising ratio of retirees to workers.

By contrast, the prospect of a declining population and diminished national power in world politics is bad news for the people who write in major news outlets about things like a declining population. This is the most obvious explanation for why we hear so much about this non-problem.

Dean Baker co-founded the Center for Economic Policy and Research (CEPR) in 1999. His areas of research include housing and macroeconomics, intellectual property, Social Security, Medicare, and European labor markets. He is the author of several books, including Rigged: How Globalization and the Rules of the Modern Economy Were Structured to Make the Rich Richer, and his analyses have appeared in many major publications, including The Atlantic, The Washington Post, Financial Times (UK), and the New York Daily News. His blog, “Beat the Press,” provides commentary on economic reporting.

Dean previously worked as a senior economist at the Economic Policy Institute and as an assistant professor at Bucknell University. He has also worked as a consultant for the World Bank, the Joint Economic Committee of the U.S. Congress, and the OECD’s Trade Union Advisory Council. He received his BA from Swarthmore College and his PhD in Economics from the University of Michigan.